In 2014, 81-year-old Glenda thought she had met the love of her life. The problem? Their entire relationship was virtual. The individual on the other end of Glenda’s computer sold her a fictional narrative that he was a United States citizen working in Nigeria. Glenda and this man developed their virtual “relationship”, never meeting in person. After some time, this man would ask Glenda for money to help his business and to get back to the United States. Glenda, wanting to help her love, immediately sent over the money. The requests became more frequent. When the small money transfers weren’t enough, he asked her to open personal and business bank accounts to transfer funds between the United States and overseas.

Despite numerous warnings from the FBI, local police, and banks to stop, Glenda still believed the man she met online loved her and needed help. She continued illegally transferring money overseas for the next 5 years a nd would eventually plead guilty to two federal felonies. Glenda was a victim of a Romance Scam and paid the ultimate price.

nd would eventually plead guilty to two federal felonies. Glenda was a victim of a Romance Scam and paid the ultimate price.

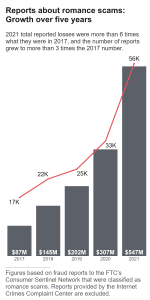

Unfortunately, Glenda’s situation, while extreme, is far from a rare occurrence today. In 2021 alone, the Federal Trade Commission (FTC) saw consumers report $547 million in losses due to romance scams, a concerning 80% more than those reported in 2020. In total, the FTC has seen an astronomical $1.3 billion in cumulative romance scam losses reported in the last five years. And these are just the scams that were reported to the FTC. Many victims go without reporting due to the shame and stigma that comes with falling prey to an online scam.

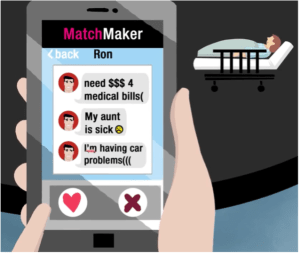

Romance scams often referred to as “sweetheart scams” occur when an individual (or group of individuals) fabricates an online persona and targets vulnerable persons for money.

These scammers build a fake relationship with the victim through messages and build empathy and trust over a short amount of time. After the relationship is built, the scammer suddenly succumbs to financial and/or medical hardships. Their initial request for money is typically a small amount and the victim may be repaid the first time to negate any doubts that this is a scam; after the second, third, and fourth request, the victim is likely never see their funds (or their “love”) again.

The elderly population is especially vulnerable to online scams. Seniors tend to be more trusting than younger generations and usually have significant financial savings (own their home, retirement savings, government benefits). Also due to cognitive decline and unfamiliarity with technology, this group is left at a disadvantage to defend themselves or recognize when someone is feigning friendship versus a genuine connection. Even more so in recent years due to COVID-19, the elderly have become even more vulnerable. Many were forced into isolation and could only stay in contact with family and loved ones by getting internet devices, opening up a whole new world. Unmonitored access to the internet coupled with increased loneliness made elders the perfect target for romance scams.

Are dating sites liable for promoting fraudsters to unsuspecting victims? The short answer is no.

Under 47 USC Section 230, interactive computer service providers (a.k.a. social media and dating sites) are immune from liability for claims arising out of the content that third parties publish to their sites.

In 2022, the Federal Trade Commission’s claims against Match Group Inc. (owner and operator of Match.com, Tinder, PlentyofFish, OkCupid, Hinge, and several other dating sites) asserting that:

- Match.com misrepresented to consumers that profiles were interested in “establishing a dating relationship”, but on numerous instances, these profiles were set up by individuals with the intent to defraud; and

- Match “exposed to consumers to the risk of fraud” by allowing accounts that were reported or flagged for fraud and under review to still exchange communication with other subscribers.

The Texas Northern District Court dismissed both counts, holding that under Section 230, Match was entitled to immunity from a third party’s fraudulent content and actions. It seems that if a victim is looking for recovery, they won’t find it in the courts or through the dating sites themselves.

This looks like a job for the FBI…

Or maybe not.

The Federal Bureau of Investigation engages its Internet Crime Complaint Center (IC3), Recovery Asset Team (RAT) and Financial Crimes Enforcement Network (FinCEN) to recover monetary losses from internet scams. Unfortunately, the FBI typically takes on international cases of single transfers over $50,000 that fall within a 72-hour reporting window. Most romance scammers typically request money from elderly victims in smaller amounts over an extended period (the median loss for romance fraud victims in their 70s is $6,450). Due to this high threshold and short reporting window, a majority of romance scam victims never report their losses or see their money again.

In reality…YOU Are Your Best Defense.

Prevent

Prevent

Do not send money to someone you have never met in person.

Advocate

Check in on your loved ones who are living alone. They may be less inclined to turn to virtual relationships and send money if they have real-life connections.

Check with banks and financial institutions about regular check-in schedules for elderly clients or talk with your loved ones to help monitor their accounts if you notice they are in a cognitive decline.

Report

If you or your loved one have been a victim of a romance scam, contact 1) your financial institution immediately; 2) report the fraud to the dating site to try and shut down the fraudster’s account; and 3) report the fraud to the Federal Trade Commission.